Feel like a holiday? You might have to queue to book on your favorite Cruise line.

Carnival Cruises experience their biggest bookings for the first half of 2022.

The world’s largest cruise line, Carnival Corp. headquartered in Florida U.S.A, have reportedly taken more bookings for cruises scheduled in the first half of 2022 than at any other time in the company’s recent history. If you want to understand global economics then look at the history of their share price below. You can see the impact of the GFC in 2008 and the impact of Covid-19.

The all-time peak in the share price was $68.56US on 19th January, 2018. As a result of the Pandemic in 2020, their share price plummeted to $8.49US on 3rd April, 2020. It has already recovered to over $20.00US. This illustrates that when people have money and feel good about the economy and their job security, they love going on holidays. Keep your eye on this share.

What is the latest roll out news for Australia?

The Health Minister Greg Hunt reported yesterday, March 18, 2021 that Australia has been very successful at containing the virus and speeding up the roll out of the vaccine. “By the end of today, we’re expecting to have over 240,000 vaccinations – over 570 aged care clinics with first doses, over 50 aged care clinics with second doses and over 50,000 aged care residents who will have been vaccinated. So I think that’s very important.”

Minister Hunt added that “the progress of the vaccine, and the containment, mean that we are ahead of schedule and it’s important to understand that we have more than three times the vaccines required for every Australian; there is more than enough to go around. As we begin phase 1B, which involves 6 million people, next week we will see approximately 250,000 vaccines available”.

In Europe, the recovery is showing signs of stalling and this could be a disaster.

The slower than expected roll out of the vaccine is resulting in lower confidence, shrinking retail and car sales, and a renewed phase of consumer de-leveraging. Downward pressure on the Eurozone economy has increased significantly in recent weeks and months. In particular, a third wave of infections is underway and the vaccine rollout has been stalled, restrictions have increased, and activity has therefore fallen sharply. A similar case exists in other Easter European countries that has low vaccination rates and increasing infections.

What about the speed of the Global vaccine roll out?

The EU expects 360 million vaccine doses to be delivered in Q2 (of which 70 million is AstraZeneca). By the end of Q1, a total of 106 million doses are expected to have been delivered (of which 30m is the AstraZeneca vaccine).

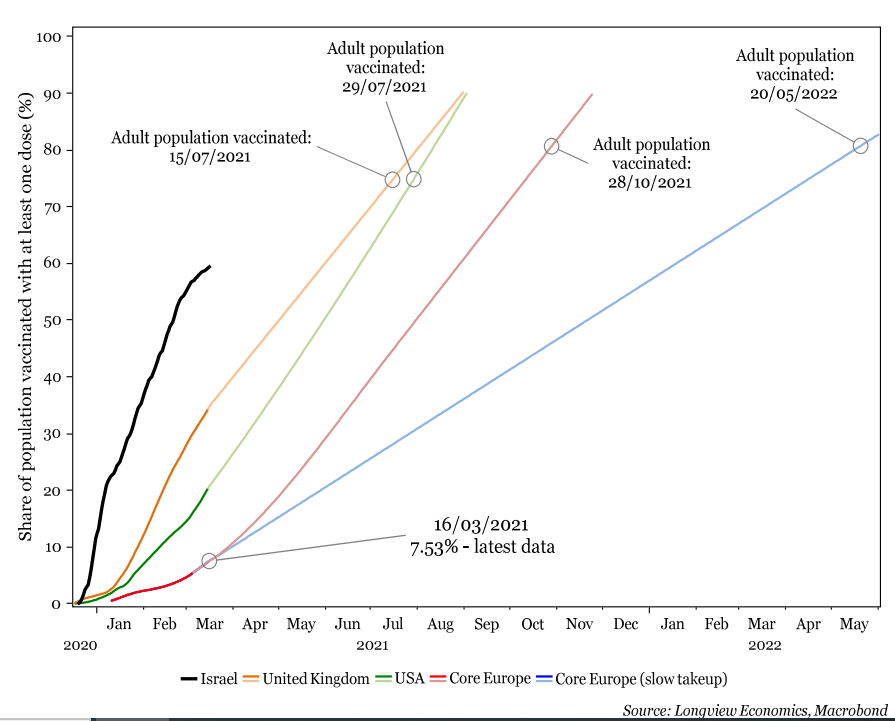

At its current pace, European countries will not receive the first round of vaccine jabs for the adult population until May next year, see the blue line above; this is very slow. A more optimistic expectation, and perhaps more realistic, is that Europe will soon accelerate the rollout (and adopt a trajectory that’s closer to the US). If that happened, the adult population would be vaccinated (with one jab) by October this year. The delay compared to the US, therefore, is likely to be somewhere between 3 – 10 months. Risks are multiple and include the possibility that, while availability of vaccines is reasonably sufficient, public confidence has been damaged (and take up is, therefore, further impeded).

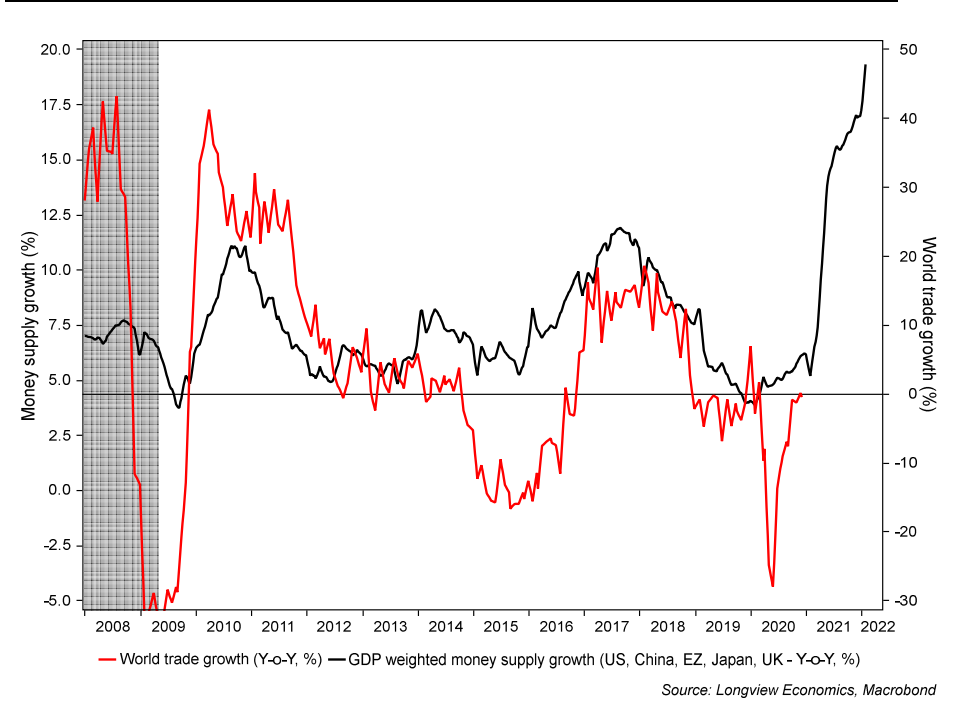

The Economic Growth that has been predicted for the latter part of 2021 and the start of 2022 can be summarised by the below chart. (the world will be awash with money)

World trade vs. ‘global’ money supply year on year.

Levels of ‘spare’ cash in the household sector are high and represent significant spending firepower, which is likely to be deployed once the economy opens up later this year. As such, and once vaccines are rolled out, there’s a reasonable chance that much of that ‘excess’ cash will be spent, resulting in robust consumption growth later this year, and into 2022.

Wealth effects from rising house prices should support confidence and consumer appetite to borrow/spend. Unsurprisingly, that relationship has broken down during recent ‘waves’ of coronavirus infections. That is why it is so critical to be both vigilant in the containment and efficient in the roll-out to accelerate to the new normal.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.