People fear inflation, but don’t know why. Some define it as an increase in price, while others point to a decline of purchasing power. Many know exactly what it means and others simply believe it’s something new.

In the U.S the market was spooked recently by a higher than expected increase in April basket of goods and services. The highest since the mid 80’s was commented in the press.

In Australia we can breathe easy because we had a lower-than-expected rise in consumer prices takes further pressure off the Reserve Bank to raise interest rates before 2024, but commercial lenders are sensing a shift in the economy and starting to raise longer-term fixed mortgage rates.

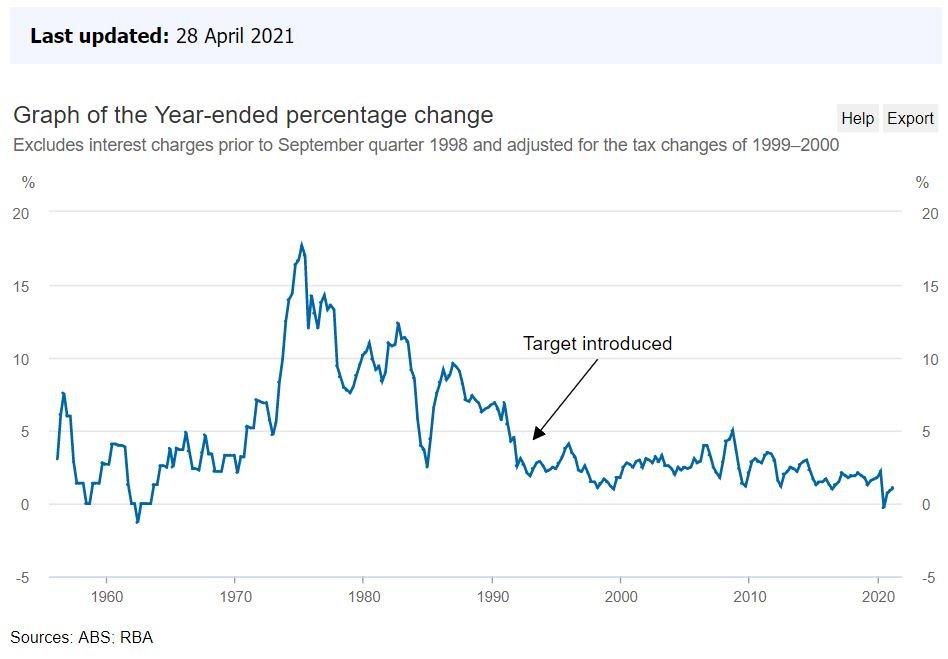

Our long term Inflation rate and the target the RBA has set to protect us.

Key points in the numbers:

- CPI increased only 0.6 per cent over the March quarter and a very good 1.1 per cent over the year to March 31

- Weaker-than-expected price increases may allow the Reserve Bank to maintain stimulus for longer

- But commercial banks are already raising interest rates on longer-term fixed mortgages

Economists were generally tipping a much larger increase in prices, of 0.9 and 1.4 per cent respectively.

That could have increased speculation that the Reserve Bank might roll back some of its extraordinary stimulus measures earlier than expected, potentially putting upward pressure on mortgage interest rates.

Building costs offset by government subsidies

Most analysts were expecting construction to contribute to inflation, with surging demand fuelled by low rates and government subsidies, plus materials and labour shortages, contributing to steep price rises for renovations and new builds.

What if Interest rates increased by just 1.00 per cent?

The recent surge in global property prices has everything to do with cheap money and job security. Our government is forecasting a jobless rate of 4.8% which is a record low once we get through the vaccine roll out.

Many people are feeling the pressure on demand for goods and services and shortages of building materials.

What if Inflation took off and the Reserve bank increased rates sooner than 2024?

According to the Australian Bureau of Statistics (ABS), the average mortgage size in Australia is $500,000 (December 2019). Depending on where you live, this may sound like a lot – or very little – and that’s because the state or capital city you live in has a major influence on the size of your mortgage.

What portion of your income should go to your mortgage?

Many lenders and mortgage experts adhere to the 28% limit – meaning your monthly mortgage repayments should not exceed 28% of your gross monthly income or the amount you earn before taxes are deducted. This percentage also puts you below the mortgage stress threshold of 30%.

According to some experts, if you are spending more than 30% of your pre-tax monthly income on mortgage payments, then you may be at risk of mortgage stress.

To illustrate, the average weekly income of full-time working adults in Australia is $1,714, according to last May’s seasonally adjusted figures from the Australian Bureau of Statistics (ABS). To get the median monthly income, we need to multiply this number by four – the number of weeks in a month – then multiply the product by .28 to get the 28% limit and .3 to find the mortgage stress threshold.

$1,714 x 4 x 0.28 = $6,856 x 0.28 = $1,919.68 (28% limit)

$1,714 x 4 x 0.28 = $6,856 x 0.3 = $2,056.80 (30% threshold)

Given these, an average working Australian should ideally allocate about $1,920 to their monthly mortgage repayment and not pay more than $2,057 to avoid falling into mortgage stress.

However, it is worth noting that each person’s financial situation is different and there are some who can allot more than 30% of their income to their monthly mortgage and still live comfortably. If interest rates increased the current average of 2.4% to lets say 4 per cent then the average mortgage of $500,000 would require a monthly increase of $437.00 per month in after tax income. look at this table to show the impact of an increase in interest rates to 4% on an average mortgage of $500,000 over 30 years of Principle and Interest.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.