This last week we have all been reminded how important Cyber security is to our everyday lives.

On Tuesday, Microsoft released its May bundle of security patches that addressed critical vulnerabilities on its exchange servers. One of these is considered critical by security researchers. It is described as a remote code execution vulnerability in Hyper-V for Windows clients and servers that “allows a guest VM to force the Hyper-V host’s kernel to read from an arbitrary, potentially invalid address,” potentially leading to denial of service.

The reason I am mentioning this is we believed that our online security was compromised by Microsoft Outlook denying us new emails for a 12 hour period. Our technicians have corrected the issue but we should all be aware and on our toes. In our case, an email was sent from a trusted source which stated “you have received an Adobe document as a request for tender”. If you received a document from Best Interest Advice on Wednesday afternoon, please do not open it as it may affect you receiving emails. The situation has now been corrected and no further action is required.

What about the U.S pipeline being hacked and the ransom being paid in Crypto?

The pipeline, which moves nearly half of the east coast’s fuel from refineries on the Gulf of Mexico, was shut down on Friday by hackers who demanded money to restore access. The FBI has blamed DarkSide, a hacking group, for the disruption.

The attack caused alarm bells to ring as the distribution and delivery of fuel is considered part of the critical infrastructure in the U.S., and a service upon which so many organizations and individuals are dependent.

But who is DarkSide? What are their motives? And what are the group’s connections with the Russian government?

Reports asking about any possible government connection may have scared the group, which doesn’t want to upset the Kremlin. As such, it may be back pedalling and trying to separate itself from any government involvement; this has prompted an official apology.

Although it has been reported that no ransom has been paid, this may signal a new disturbing trend that the payment demand was to be made in Cryptocurrencies. If this is the case, then U.S authorities should now accelerate the compliance framework of all Cryptos to buy in. The surge in buying has pushed fuel prices to their highest levels in six years.

What are the take-outs from this weeks budget?

Most of the changes announced need to be legislated and will become law from 1st July, 2022. As there was no rebuttal about super contribution increases, it can be inferred that the rate of super guarantee will increase to 10% from 1 July, 2021, and then continue to rise in annual increments of 0.5% until it reaches 12.0% from 1 July, 2025. There were also a number of other superannuation announcements that could have a significant (and positive) impact on the wealth plans of many Australians which includes increasing the amount that can be accessed from super towards the purchase of a first home and, at the other end of the home ownership journey, a lowering of the eligibility age to 60 to make a downsizer contribution to super.

For Self-managed Superannuation Funds only, there is a relaxing of the residency requirements from 2 years to 5 years. This will make it more attractive for members of SMSF’s to keep contributing even though they are not living in Australia. This brings them into line with other public offer funds.

What about the markets, particularly Asia?

Asia-Pacific ETFs are funds that invest primarily into companies based in the Asia-Pacific region. These companies are typically based in Hong Kong, South Korea and Japan.

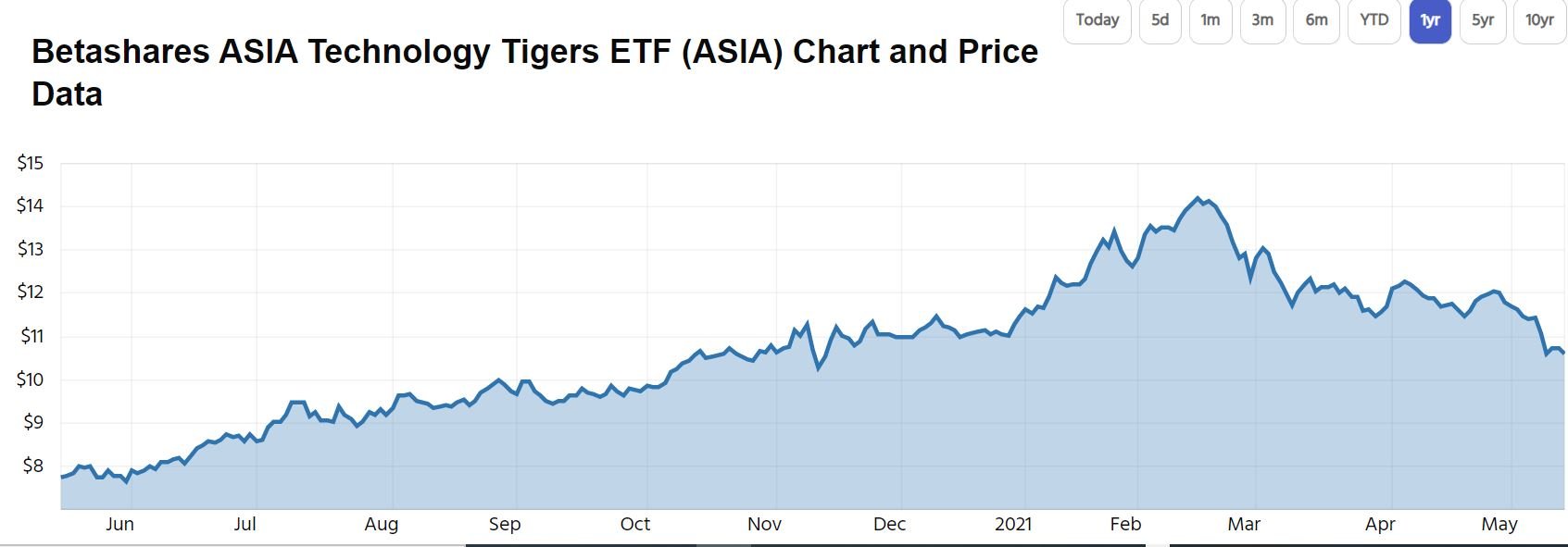

The Asian markets have retreated recently and in particular, the Asian technology ETF has come back from $14.20 on 15th February, 2021 to $10.72 on 13th May, 2021 as the above chart shows. This is a decline of almost 40%! This illustrates how vulnerable this sector is, however it still shows a positive return over the last 12 months of 36.82%.

Over the longer period, this sector is expected to continue its bullish outlook. It makes even better investment sense to diversify more into some of the Australian technology stocks.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.