Victorian small business and retail will wear the brunt of this lockdown

It may be billed as just one week, but for casual workers and small business owners, the fourth Victorian lockdown that starts today is terrifying.

- 500,000 people in Victoria are in casual jobs with little job security during a pandemic

- Small business owners are furious that a snap lockdown was announced without a comprehensive support package for their industry.

- Early estimates from the lobby group Small Business Australia place the cost of this seven-day Victorian lockdown at $1 billion in lost economic activity, while the Grattan Institute puts it at slightly lower at $900 million.

The Commonwealth Bank’s chief economist, Gareth Aird, is estimating an even higher cost. “We think that the direct cost of the seven-day lockdown in Victoria will be around $1.3 billion,” he said.

The global outlook is still positive

Global prospects remain highly uncertain one year into the pandemic. New virus mutations from India and the United Kingdom and the accumulating human toll raises concerns, even as growing vaccine coverage lifts sentiment. Economic recoveries are diverging across states, countries and sectors, reflecting variation in pandemic-induced disruptions and the extent of policy support. The outlook depends not just on the outcome of the battle between the virus and vaccines, it also hinges on how effectively economic policies deployed by the Victorian State Government and the Federal Government, under high uncertainty, can limit lasting damage from this unprecedented crisis.

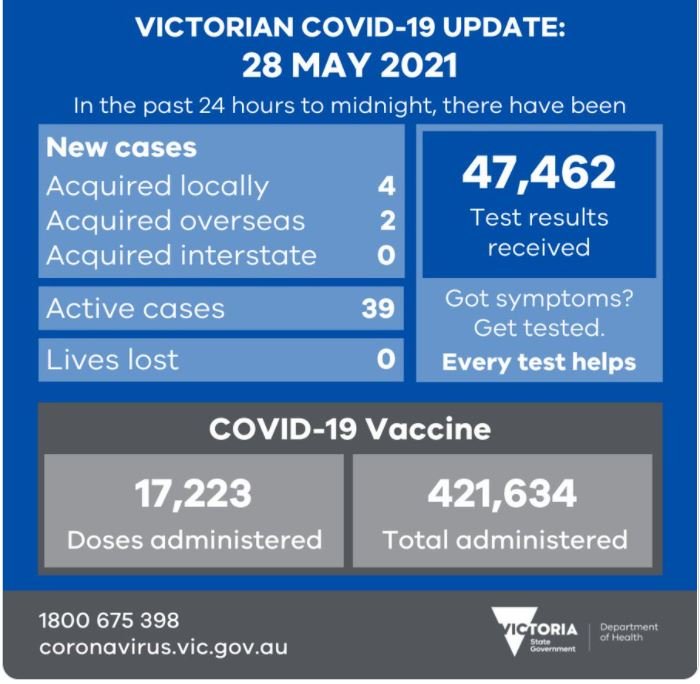

Victorian numbers

Victorian’s COVID-19 testing numbers have set a new daily record of 47,000 as officials combat the latest outbreak.

What about the continuation of economic growth?

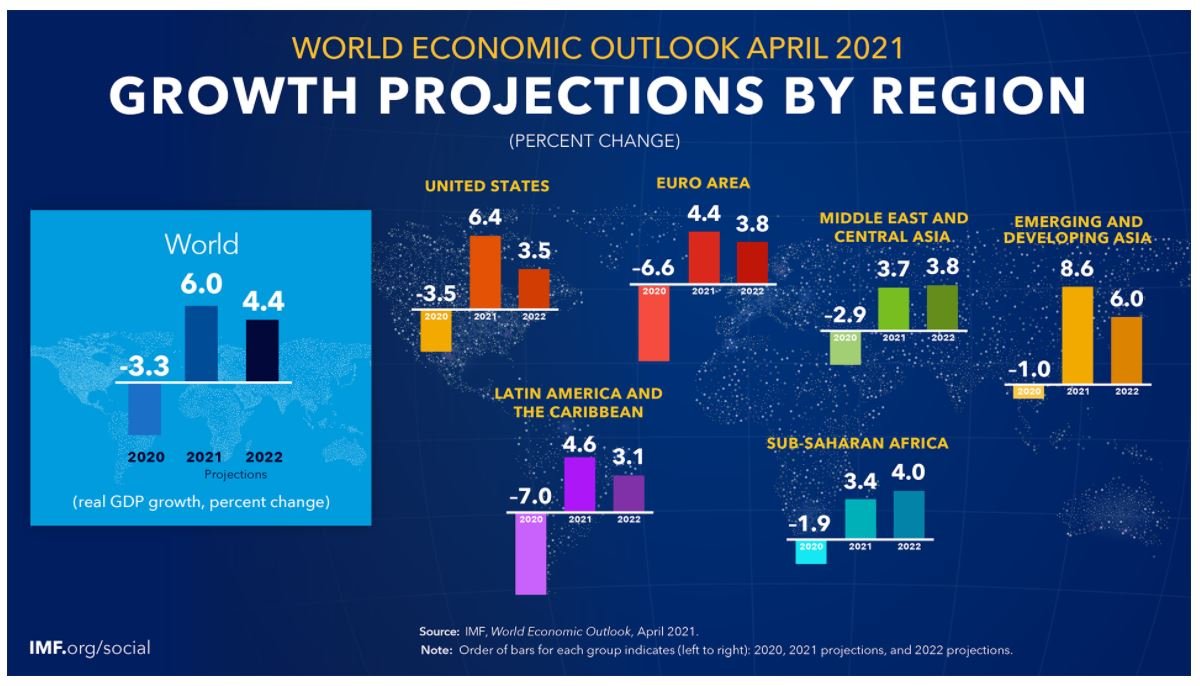

According to the IMF report on the impact of the Pandemic, the global economy will recover from a contraction of –3.3 percent in 2020, and is projected to grow at 6 percent in 2021, moderating to 4.4 percent in 2022. This will mean that share markets will remain buoyant for the remainder of this year.

Future developments will depend on the path of the health crisis, including whether the new COVID-19 strains prove susceptible to vaccines or they prolong the pandemic. The effectiveness of policy actions to limit persistent economic damage (scarring) and the evolution of financial conditions and commodity prices, along with the adjustment capacity of the economy, will ensure long term recovery.

What are the downside risks?

The main downside risk factors include the following:

Pandemic resurgence: Vaccine-resistant strains are potential headwinds for economic activity, as are operational risks, such as vaccine production and distribution delays. Excessive staggering across different regions: This may trigger start-stop patterns in the response to re-emerging infection hotspots, extending the period of social distancing and uncertainty facing households, firms, and policymakers. Moreover, if mutations outpace the rollout of vaccines, COVID-19 could become an endemic disease of

unknown severity.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.