October saw the Australian sharemarket take a breather, remaining flat but this did not dissuade ETF investors from continuing to allocate to domestic equities, in a month with continued strong net flows. Just like last month we saw continued high levels of flows into both Australian and International equities, although once again international equities dominated ($621m and $904m respectively).

What is an ETF?

An ETF is called an exchange traded fund because it’s traded on an exchange just like shares are. The price of an ETF’s will change throughout the trading day as the shares are bought and sold on the market.

Why are ETFs’ so popular?

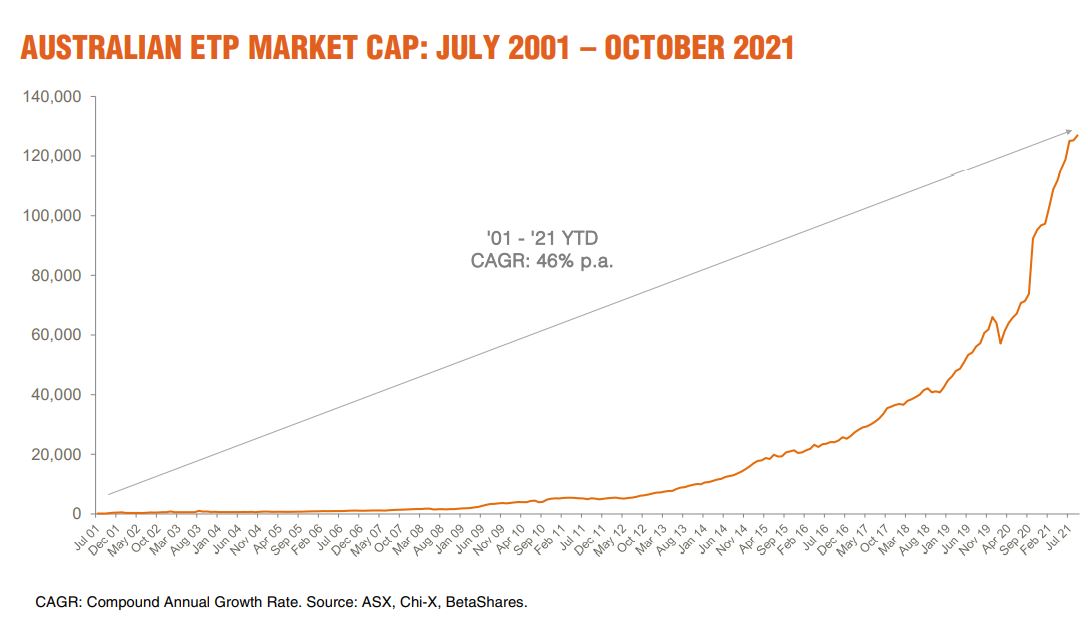

In 2008 I predicted that exchange traded funds would become the preferred way to invest in the future. I was a pioneer in Australia, giving presentations at the ASX in Sydney and how I was using ETF’s in client portfolios. I fell in love with ETF’s because they could be easily traded each day, your funds were never frozen like managed funds and they were low cost.

Most financial advisers used managed funds in the past to provide allocation between managers (don’t put all your eggs in the one basket) and asset classes (property, shares and fixed interest) until ETF’s became well known and widely used. Most Robo advisers use ETF’s for automated model portfolios.

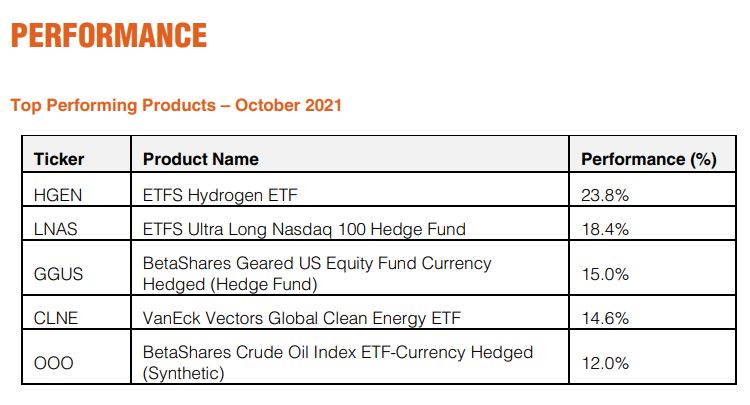

What are the best performing ETF’s

Best performance this month came from hydrogen exposures, followed by Geared U.S. Equities products.

Compare the longer term ETF performance-over 10 years

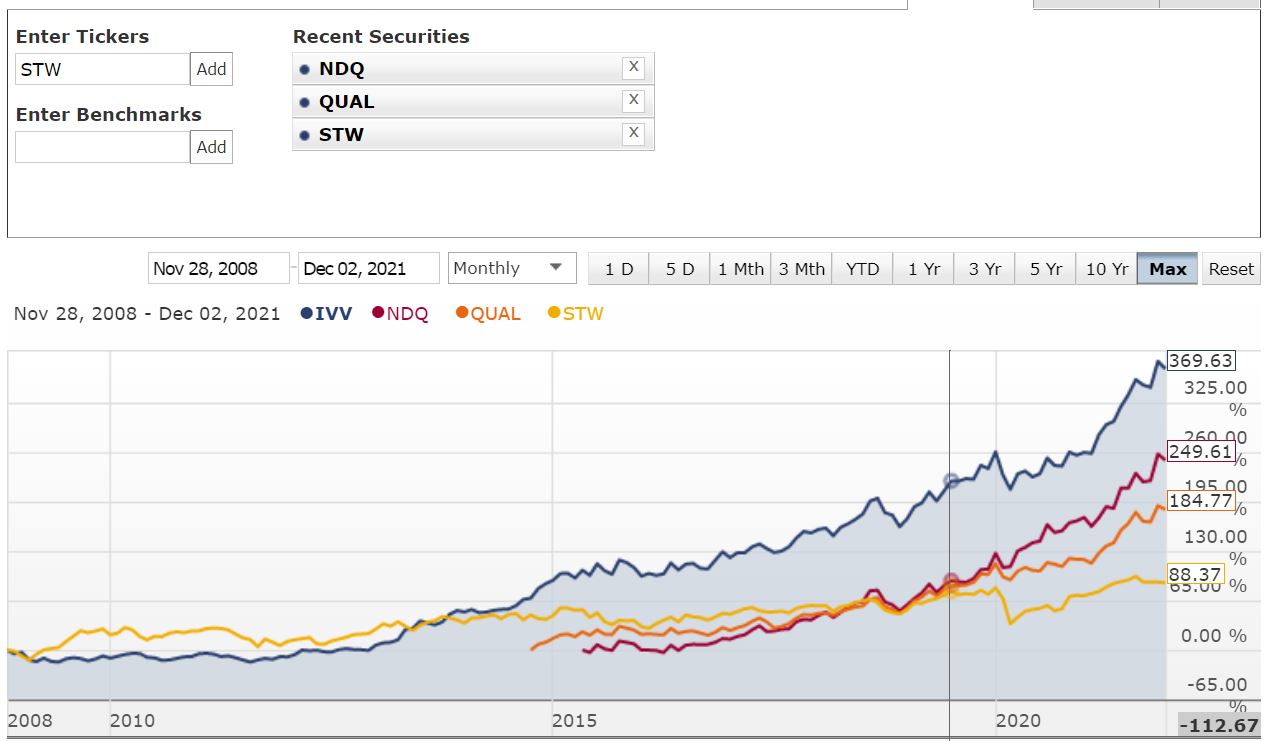

We have constructed portfolio’s for our clients for over 10 years using ETF’s and the three indexes we almost always use are S&P 500 in the U.S, the Nasdaq index in the U.S the MSCI world index and the Australian index.

Our asset consultants from London over that period have always advised us to go overweight the U.S stock market and that strategy has paid handsomely for our clients.

You can see the comparison of the S&P 500 index (IVV) and the Australian share index presented by STW. The difference over ten years is phenomenal as you can see by the graph.

The other ETF’s in this graph are the Nasdaq ETF (NDQ) and the MSCI index (QUAL) only started trading in 2014 and 2016.

How do you invest in ETF’s?

You can invest in ETF’s via most trading platforms. However, if it is Netwealth, Hub24 and or BT Panorama then you may have investment limits per ETF’s.

If you have a SMSF then you have total control over your asset allocation and you could invest in any ETF without limitations.

How to set up a time to discuss how to pick the best ETF’s

You can nominate a time to discuss a tailored portfolio of ETF’s for your super or for your savings and investment account. Click on this link and go to the bottom of the page to our calendar and put in a time. We will get back to you. https://bestinterest.com.au

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.