When cryptocurrency started trading in 2009, it certainly wasn’t front of mind for SMSF investors, especially those in retirement. Even after the Global Financial Crisis (GFC) in 2008, they remained wedded to those traditional mainstays of their portfolios; fully franked Australian blue chips, cash and fixed deposits, and property (residential and commercial). That is about to change!

The growth of Crypto currency in SMSF’s

In the ATO’s June 2019 quarterly figures, Crypto currencies totaled $190 million in SMSF portfolios which means Crypto is gaining more attention from the 1.1 million SMSF members who have more than half a million SMSF funds. As at June 30, 2021 more than $212 million was invested in this asset class.

It’s gaining a lot more attention from the over 60’s because of the tax advantages. This asset class is not for everyone and you need to address the investment strategy of the fund to accommodate it.

Many investors are experimenting with Crypto to try and understand what “Blockchain” is and why the price keeps going up and up.

It’s not all about Bitcoin

Initially, it was Bitcoin that attracted all the hype around Blockchain. But the market is now maturing with one example being the continuing emergence of new coins. In the past two years, blockchains such as Solana, Polkadot and most noticeably, Dogecoin have joined the top of the crypto market with Dogecoin also enjoying a sharp price increase this year. Perhaps even more important to note is the growing debate around crypto regulation, with every discussion in every jurisdiction just further evidence of how this market is maturing and therefore, becoming increasingly mainstream.

We have witnessed cryptocurrency become the national currency in the Central American country of El Salvador. Big players such as Tesla and PayPal are now accepting it as a payment method, as well as the growing conversation around the ability to use crypto to pay for everyday goods and services. Services like Crypto.com issue a Visa card when you register.

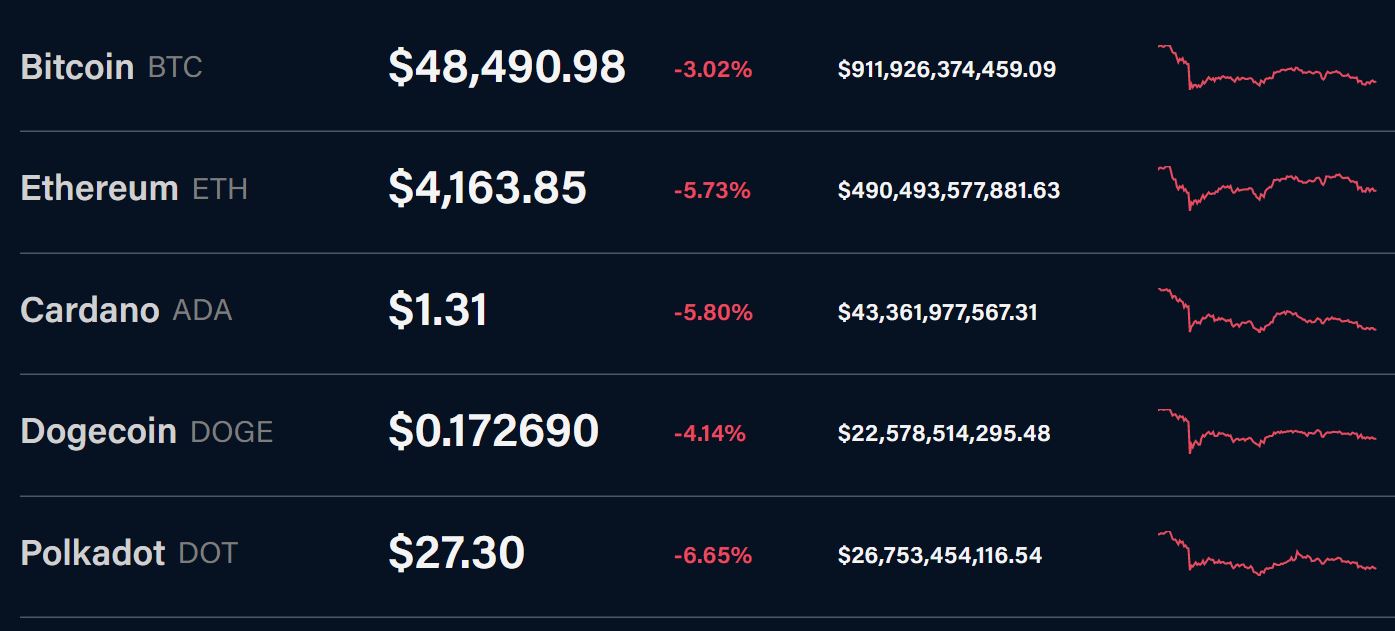

Today’s price in U.S dollars.

How do I set up my self managed super fund to trade Crypto?

Best Interest Advice have a separate self managed super administration division located in Sydney. They are award winning administrators and are able to help you set up your fund, establish the Crypto register and prepare your year end tax work.

https://selfmanagedsuper.com.au

Make sure that you stay on top of the tax

In Australia, it’s not just the crypto SMSF numbers that the ATO is keeping an eye on. In what is further evidence of this asset joining the investment mainstream, the ATO has warned about the capital gains tax implications from investing in cryptocurrency. Any currency held in an SMSF must abide with the extensive regulations that govern SMSFs; the Superannuation Industry (Supervision) Regulations 1994 (SISR) and the Superannuation Industry (Supervision) Act (SISA). Apart from anything else, it requires all transactions to be documented.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. I want to acknowledge the contribution of Cointree in providing some content in this article.