You need to look at the results

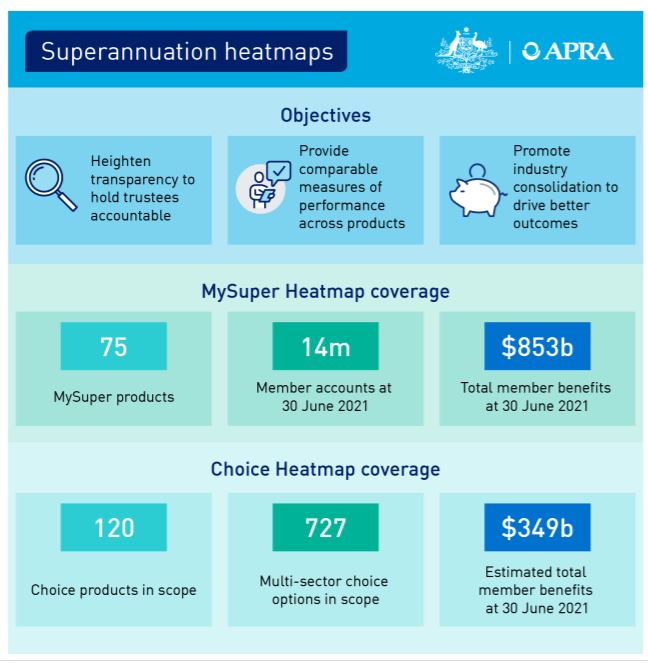

According to Australian Prudential Regulatory Authority (APRA), as many as 45 per cent of MySuper products, or 31 out of 69, delivered returns below its heatmap benchmarks, with the number of poor-performing products reaching 60 per cent across the Choice Heatmap. Executive board member Margaret Cole said APRA would now further intensify its supervision on the trustees of products that had been shown up on the heatmaps as delivering sub-standard member outcomes.

What is the difference between My Super products and Choice products?

MySuper products offer a single investment option and are designed to be simple, low cost default products for members that do not to make an active decision on their investment strategy.

Choice products and options are those in which members have made an active decision to invest and are aimed at members seeking greater flexibility.

Should I get advice on selecting my investment choice option?

Absolutely. In the Choice of investment option category many superannuation members have fallen foul by selecting an inferior option without any assistance and that has been shown to perform poorly against the APRA benchmark. Their are 727 investment options that have been included in the choice analysis report and 60% failed the test.

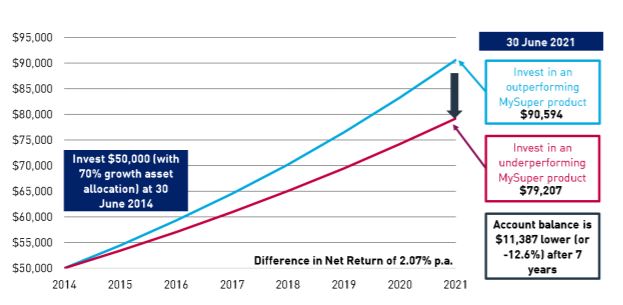

Actual growth of $50,000 in a members account over 7 years.

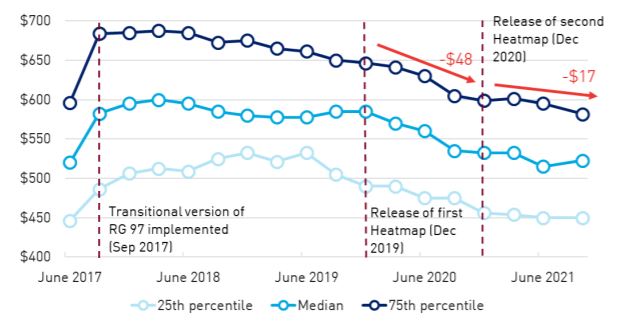

What about fees? Do they make a big difference on $50,000?

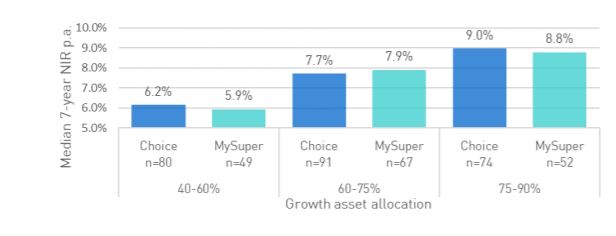

Does a good choice option deliver better outcome than a My Super option?

In two out of three asset allocation categories (conservative, balanced and growth) a choice strategy delivered better performance. This means that if you actively get involved with your super and you pay to get advice on a more suitable superannuation fund with lower fees and a better investment choice you are more likely to get a better outcome.

Source: APRA My Super and Choice Heatmaps 16th December 2021. APRA allows us to copy and reproduce parts of the publication, it does not endorse our work or opinions on its relevance.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. I want to acknowledge the contribution of Cointree in providing some content in this article.