This time of the year we generally reflect on the major surprises that we didn’t see coming. In a volatile investment climate as a result of the ongoing Pandemic and cheap money we have seen the S&P 500 reach a new record high this week. Every Australian who owned property and a basket of shares in their super are wealthier than they were at the end of 2020.

Here are some of the big surprises.

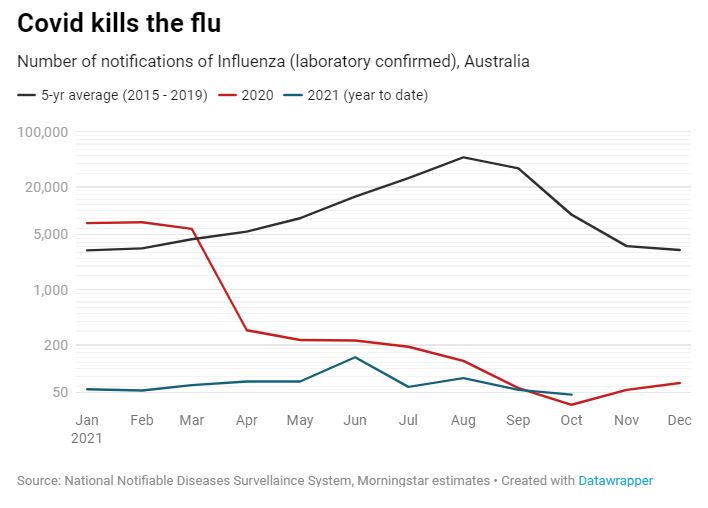

Influenza rates plummet

Who would’ve guessed? Measures to contain a highly contagious respiratory disease (Covid-19) would contain the highly contagious normal run of the mill influenza.

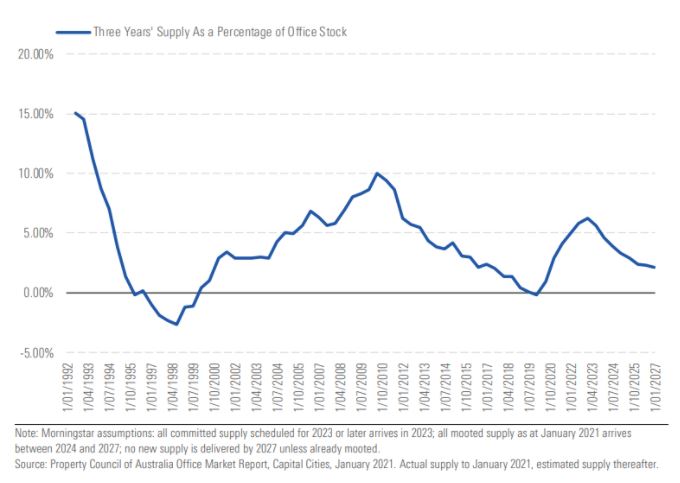

The death of the office. What about the future occupancy rates?

As the craze for working from home spread around the globe, city offices were sitting empty and vacancy rate were thought to be on the increase. In fact that was not the case. The below chart dispels that thought. The GFC in 2008 had a far greater impact.

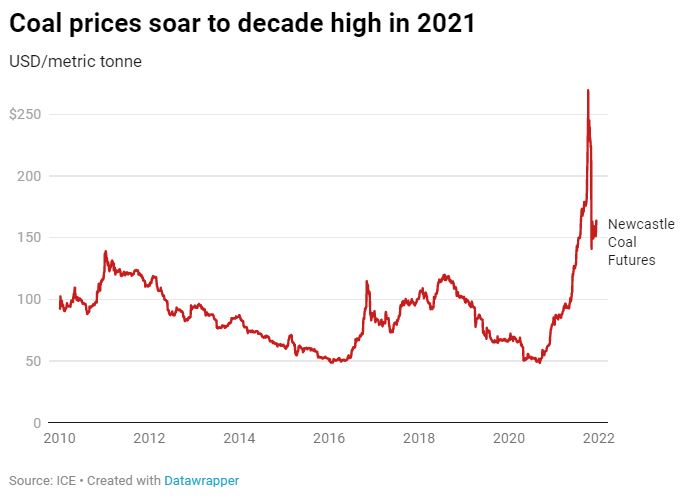

Going green spells the end for fossil fuels

The year 2021 is when everything seemed to go green. Investors were rushing to ESG (environmental, social and governance investing) as Elon Musk was riding a wave of popularity as the move to battery powered cars went crazy. In fact Oil companies and coal producers enjoyed a record year. As Australian banks cut back lending due to ESG concerns, coal miners like Whitehaven Coal are up more than 50% year to date thanks to the highest prices in a decade.

Why higher inflation spooks markets

There’s no simple link between inflation and the share market.

Firms like Apple can pass on higher costs to customers without turning them away. Those unable to pass on costs could see inflation cut into margins. Even in lockdown, firms felt they could pass on price rises in 2021. That’s a stark contrast to last year where there was much greater hesitation to pass that on.

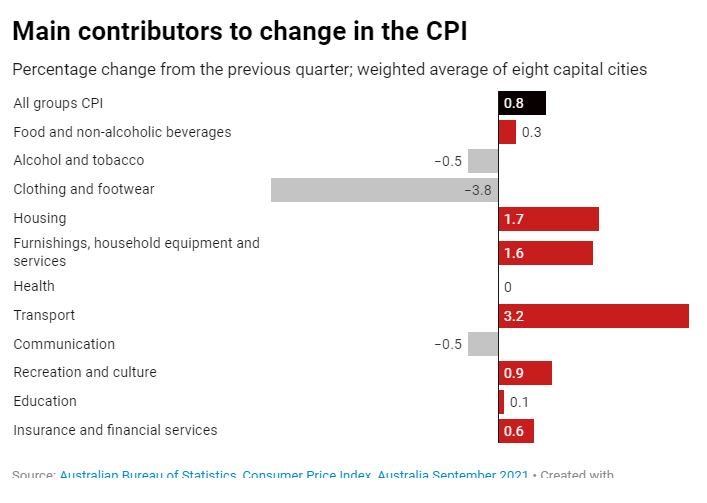

The investment markets are so jittery when it comes to inflation that when the broad Consumer Price Index rose 0.8% for the September quarter, jumping 3% year-on-year. The Reserve Bank’s preferred measure edged into the bank’s 2%-3% target range for the first time since 2015.

Markets took the news badly. The ASX 200 dropped 0.5% following the 11.30am data release. Bonds sold off on the expectation of higher interest rates into 2022.

Fuel was the biggest mover in the September quarter, jumping 7.1% as the price of Brent crude oil, the global benchmark, hit the highest level since 2014.

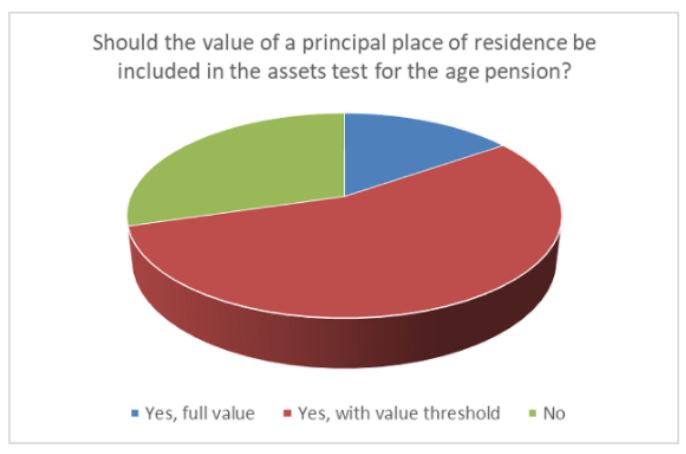

Should wealthy Australians have the value of their home included in eligibility for pensions?

With skyrocketing property prices and the pressure on the budget because of age pension support and life expectancy going up, this topic came up again in conversation during the year.

Should wealthy Australians that are getting a handout from the government still have the home they live in exempt under the assets test or should they be encouraged to sell down and provide for themselves?

The chart below is from an article published by Morningstar that collated what the average Aussie thought of including the family home in the assets test.

See you in 2022.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. I want to acknowledge the contribution of Cointree in providing some content in this article.