As we all start to return to our jobs from our holiday break we are faced with new record infection rates around the world from the Omicron strain and the threat of inflation taking off.

Here are some of the main items to help you get on the front foot in 2022.

Will omicron variant derail the recovery?

As new information on the Omicron variant continues to emerge, views remain mixed over its potential impact. On one hand, several recent pieces of evidence (continue to) confirm that mortality related to this variant is lower than prior variants. French ICU data shows that Covid patients are being discharged at faster rates than during previous waves.

Mortality modelling with Covid has a history of overestimating the rate of deaths. The Imperial college in London at the beginning of the Pandemic estimated 510,000 deaths in the U.K which was 10 times more than the actual.

The metric to measure the transmissibility of the variant (Variant Fold Reduction) VFR shows that the transmissibility of Omicron is greater than Delta variant but the death rate is low. The major threat is the impact on hospitalisation rates and ICU care.

The U.S government are now moving away from publishing case numbers to reporting on the severity of the cases.

This means that the Governments will move away from Lockdowns, travel restrictions etc. to more targeted measures like aid/treatment for the infected. Such a shift would be positive for the global economy

Australian Stocks recover from yesterday

The S&P/ASX200 is up today, gaining 88.40 points or 1.20% to 7,446.70, despite crossing below its 125-day moving average. The top performing stocks in this index are MEDIBANK PRIVATE LIMITED and UNIBAIL-RODAMCO-WESTFIELD, up 6.03% and 5.63% respectively. Over the last five days, the index is virtually unchanged, but is currently 2.44% below its 52-week high.

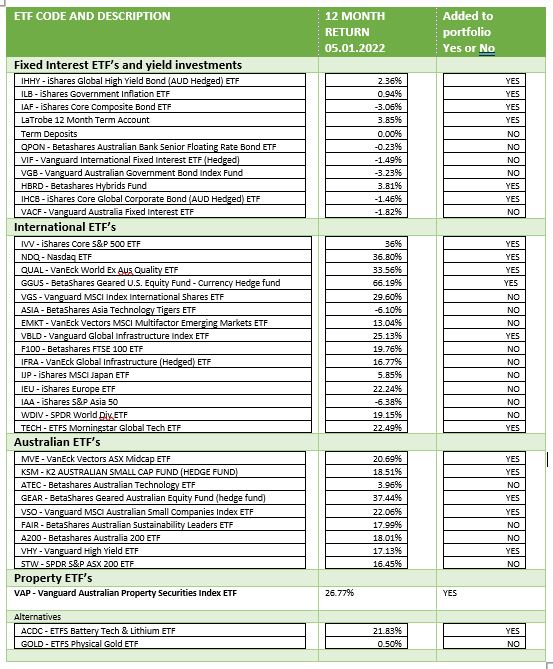

The return on our approved ETF’s in 2021

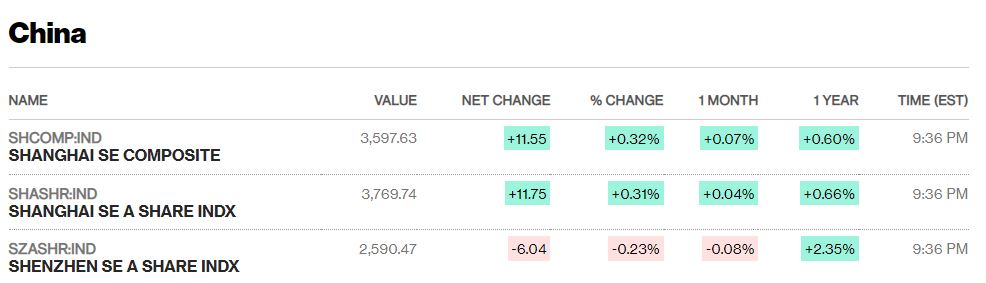

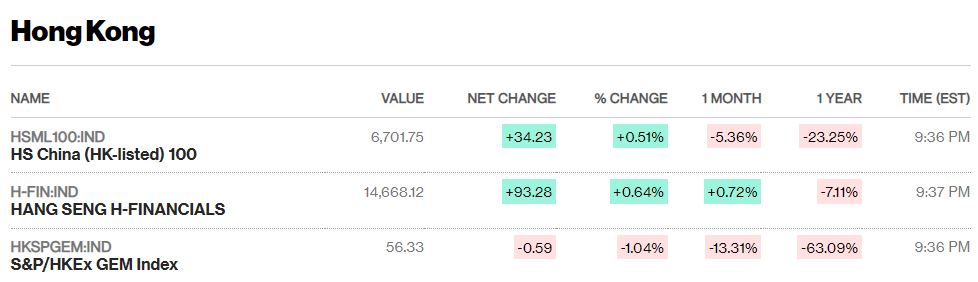

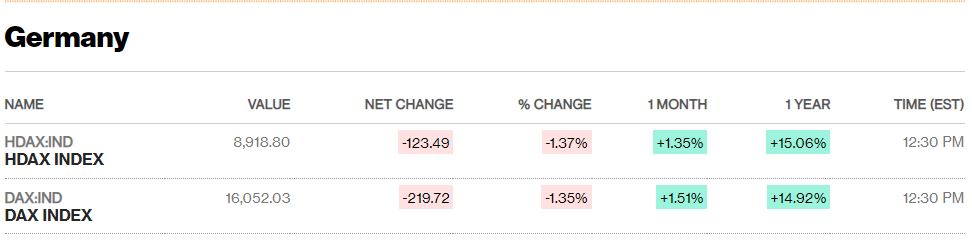

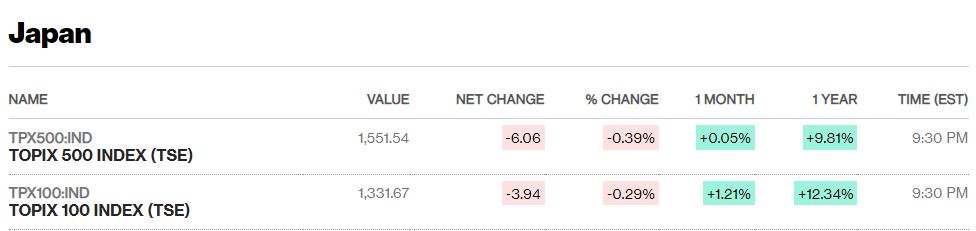

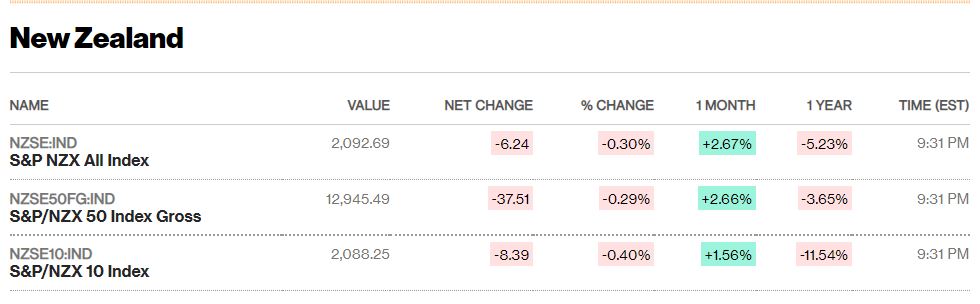

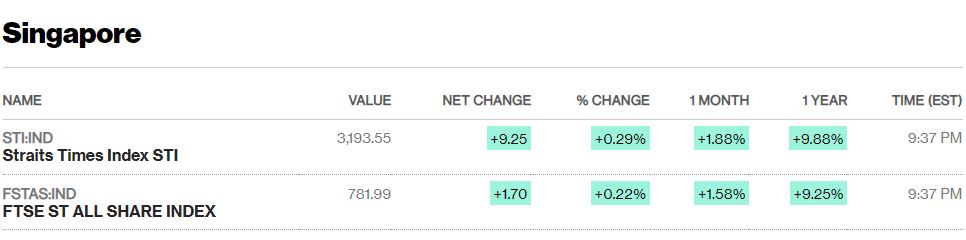

What about the other markets around the world? Look at the 12 month performance

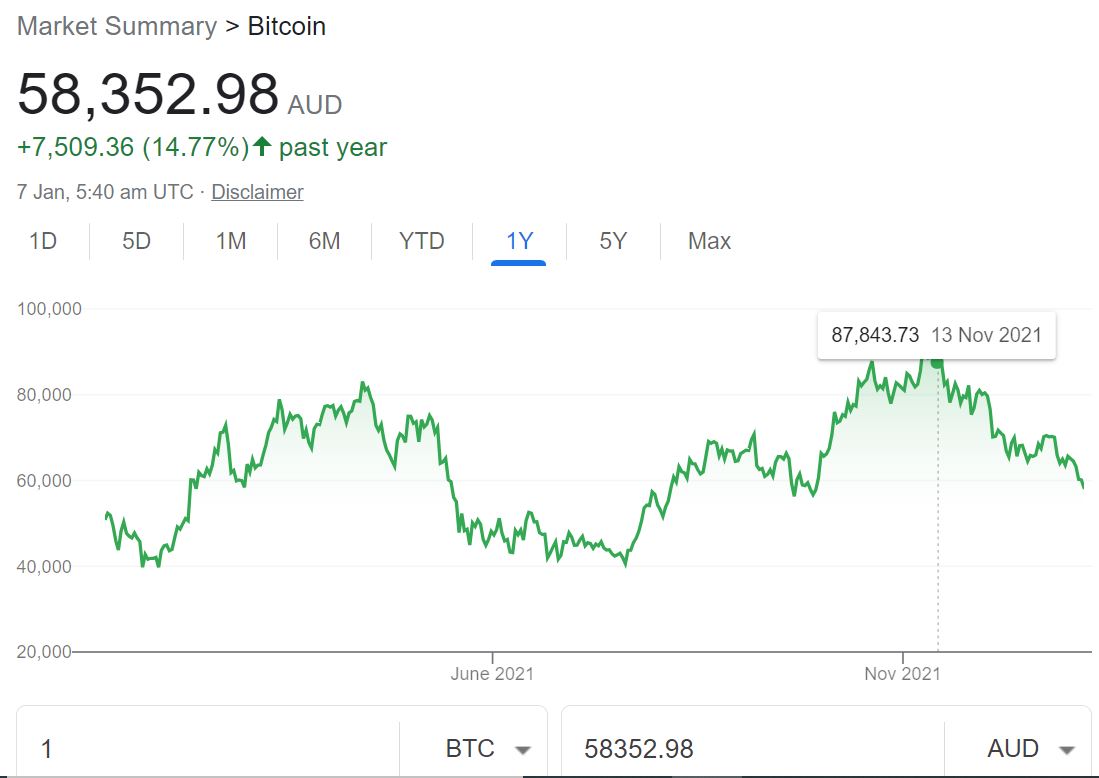

What about crypto?

The value of bitcoin, ethereum and other major cryptocurrencies plummeted Thursday after minutes from the Federal Reserve’s latest meeting signaled a possible shift towards more aggressive action from the bank as it scales back pandemic support and moves to tackle high levels of inflation. THE VALUE OF BITCOIN IN THE LAST 12 MONTHS HAS GONE UP ONLY 14.77%. Seems like a small reward for a huge risk.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. I want to acknowledge the contribution of Cointree in providing some content in this article.