More than two-thirds of investors are anticipating a stock market pullback before the end of the year, research suggests, amid concerns over growth prospects and the Covid-19 Delta variant.

According to a poll of over 550 global investors by Deutsche Bank, an equity correction sometime before the end of the year is “an overwhelming consensus now”, with 58% forecasting a drop of 5% to 10%.

One in 10 expect a steeper tumble, while just less than a third predict markets will avoid stumbling in the next few months.

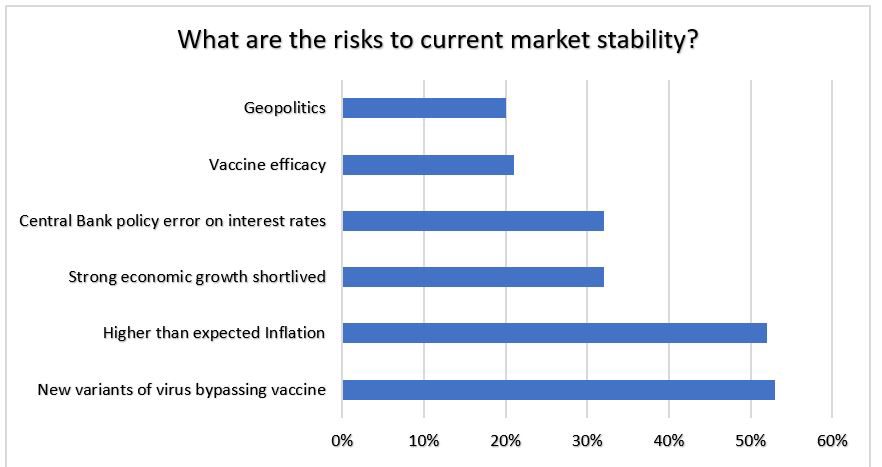

The possibility of new Covid-19 variants that bypass vaccines pose the biggest risk to market stability, closely followed by higher than expected inflation, the survey found.

Investors also warned that weaker-than-expected economic growth was a potential risk, along with the danger of a central bank policy error, in which rising prices prompt monetary policy to be tightened too early.

Global share prices have risen by about 90% since the depths of the market crash in March 2020, lifted by central bank stimulus packages, government spending and successful vaccine rollouts that have allowed economies to reopen.

The S&P 500 index of US shares and the Europe-wide Stoxx 600 have hit a series of record highs this year, with both gaining about 18% during 2021 – much more than an average year.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.