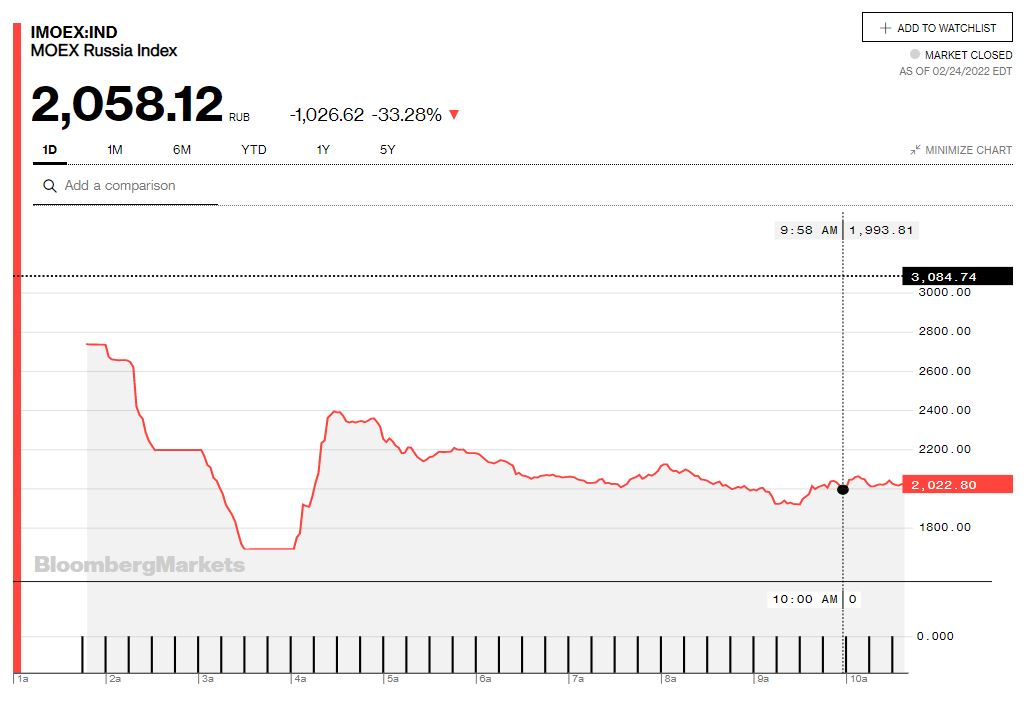

Russia’s share market crash on Thursday is the fifth-worst plunge in equity market history, following the country’s invasion of Ukraine.

University of Sydney’s School of Chemical and Biomolecular Engineering Professor Yuan Chen believes “The current oil and gas supply chain issues and increased electricity prices in Europe are a short-term problem. Europe’s winter is almost over and with it, its seasonal energy needs. If the current issues continue, there is plenty of liquified natural gas produced in the US and the Middle East that can be shipped to Europe – but at a higher cost than those imported from Russia.”

“Globally, there are more than enough fossil fuels (coal, oil, and gas) Europe can use. The real issue is that if we continue getting most of our energy from fossil fuels, CO2 emissions will continue rising, which is the far bigger, long-term problem.”

Sanctions May Not Stop an Irrational Vladimir Putin

The Russian president is doing his country and himself harm by invading Ukraine. He doesn’t care! It’s a huge mistake, and it should be obvious to anyone. It isolates Russia and dooms it to self-sufficiency and isolates it economically. No one will want to negotiate with Putin or his clique, because it’s clear that they will cross any line to get what they want.

Don’t disagree with Putin. Click to see how he dresses down his head of Intelligence.

…On the other side of the world, U.S markets record the biggest one day turnaround for Technology stocks in decades.

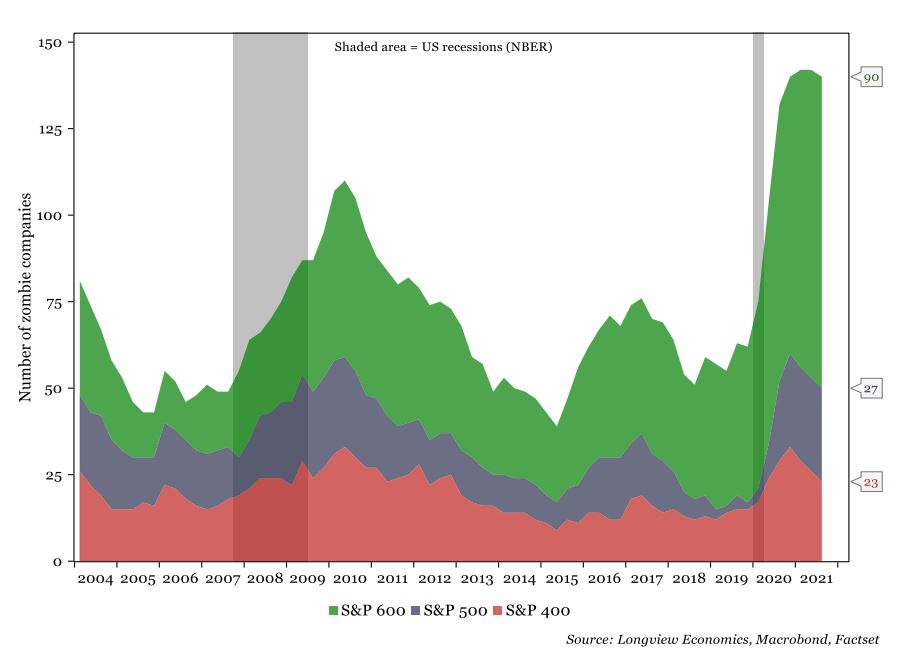

Tightening Liquidity: A Zombie Apocalypse?

Ever since the GFC, unprecedented fiscal and monetary support for private and public firms, both in the US and around the world, has saved many companies from failing. With that, a bank of “zombie firms” has built up. These are firms which are barely surviving, living effectively on ‘monetary life support’, i.e. cheap money.

Zombie companies are essentially companies which are unable to generate enough profit to cover debt-servicing costs and, therefore, need to borrow to stay alive. See chart below from Longview economics.

Longview economics in London, our asset consultant, have analysed the earnings filings of the S&P 1500 (which is made up of the large-cap S&P 500, the mid-cap S&P 400 and small-cap S&P 600 indices), through to the end of Q3 2021. As there is no official definition of a zombie company, they have used four definitions based on varying timeframes and tightness of rules in this analysis. Those are detailed in the Table above. The principles behind the definitions are consistent, though. Longview economics are looking to find companies that have paid more interest than received in pre-tax earnings over the past 2 or 5 years. Two of the measures look at that metric in aggregate (i.e. over the whole time period), while the other two also require that interest payments aren’t covered by EBIT in at least 75% of the reporting quarters. Longview analysis excludes new companies or those without sufficient data, and exclude those growing (in revenue terms) at a rapid rate.

For much of the past 8 quarters, oil/energy prices have been low and, as such, 43% of the energy sector companies have taken a significant hit to their EBIT and have been unable to cover interest payments. Other key sectors include Real Estate, the Airline industry (within Industrials), and the Hotel & Leisure industry (within Consumer Discretionary).

Ironically, with the war in the Ukraine, oil and energy prices have skyrocketed and this will help them recover and eases pressure on interest costs.

In conclusion.

While the build-up of zombie companies is significant, the main cause is pandemic related. As the global economy continues to reopen, many of these companies should therefore return to profitability. There remains a number of, particularly smaller, companies that are in an extremely unhealthy position that are highly exposed to the rising rate environment and need to be carefully monitored. A move away from growth stocks to value stocks will be more common.

A new ETF that focuses on Value companies

During times of inflation and military conflict, companies with actual earnings can boost profit margins by raising prices. Value companies, which tend to be more mature, have earnings and margins to improve. Investors recognise this, so in the current environment, they are more attracted to invest in these companies. In contrast, growth companies tend to be characterised by expected future earnings, so they benefit less from price rises. There are other reasons the ‘value-trade’ could continue to do well into 2022. A rising interest rate environment favours value stocks. Value stocks tend to do well after recessions and when COVID cases decline and the conflict in the Ukraine eases, economic activity and mobility will improve value stocks.

One way to incorporate value international equities is the new ETF with the ASX code VLUE which listed on ASX in 2021 and the new equal weighting U.S QUS from Betashares.

VLUE offers exposure to 250 international large and mid-cap companies with high value scores determined by MSCI.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L