The Election budget. As the post-pandemic economic recovery continues to take shape, Australian Federal Treasurer Josh Frydenberg has handed down the 2022-23 Federal Budget.

Among the proposed changes, he announced a temporary cut to fuel excise, help for home buyers and extended relief for retirees, as well as a one-off cost of living payment to millions of Australians. Read on for a round-up of how the proposals might affect your household expenses and financial future. Remember, many of these proposals could change as legislation passes through parliament.

Let’s look at Superannuation

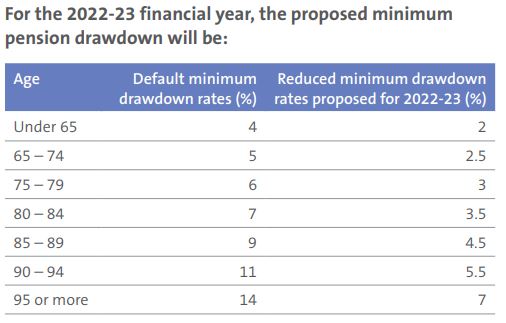

Temporarily extending the minimum pension drawdown relief Proposed effective date: 1 July 2022 The temporary reduction to the minimum income drawdown requirement for superannuation pensions will be further extended until 30 June 2023. This will allow people to minimise the need to sell down assets given ongoing market volatility. It applies to account-based, transition to retirement and term allocated superannuation pensions.

Let’s look at Tax

Proposed effective date: 30 March 2022

Fuel excise will temporarily be cut by half, or 22.1 cents per litre, to save families an estimated $30 a week. This measure will end on 28 September 2022.

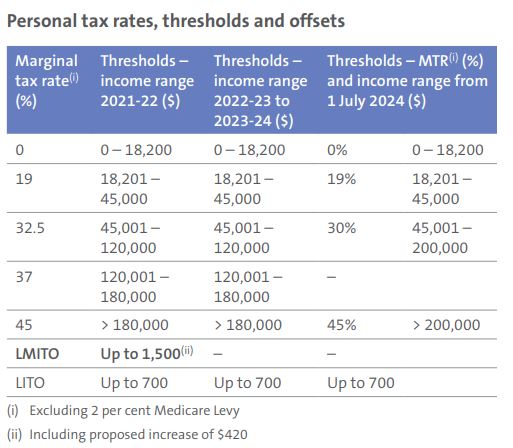

Increasing the Low and Middle Income Tax Offset (LMITO)

Proposed effective date: 1 July 2021

The LMITO will be increased to up to $1,500 for the 2021-22 financial year. All eligible LMITO recipients will benefit from the full $420 increase, referred to as the Cost of Living Tax Offset. – The benefit for those earning up to $37,000 will be $675 (currently $255). – For those earning between $37,000 and $48,000, the offset will increase at the rate of 7.5 cents per $1 above $37,000 to a maximum of $1,500 (currently $1,080). – Those earning between $48,000 and $90,000 are eligible for the maximum LMITO benefit of $1,500 (currently $1,080). – For income above $90,000, the offset phases out at a rate of 3 cents per $1 and is not available when taxable income exceeds $126,000. – The LMITO is due to end on 30 June 2022 and has not been extended.

Increasing the Medicare levy low-income thresholds

Proposed effective date: 1 July 2021

Low-income taxpayers will generally continue to be exempt from paying the Medicare levy. The threshold for: – Singles will be increased from $23,226 to $23,365 – Families will be increased from $39,167 to $39,402 – Single seniors and pensioners will be increased from $36,705 to $36,925 – Families (seniors and pensioners) will be increased from $51,094 to $51,401. For each dependent child or student, the family income thresholds increase by a further $3,619.

Social security, families and aged care

Proposed effective date: 28 April 2022 onwards

To help with higher cost of living pressures, the Government will provide a one-off tax-free payment of $250 to Australians who receive qualifying social security payments or hold eligible concession cards, including: – Age Pension – Disability Support Pension – Carer Payment – Carer Allowance Jobseeker Payment – Pensioner Concession Card holders – Commonwealth Seniors Health Card holders. An individual can only receive one payment, even if they’re eligible for multiple benefits or concession cards.

Enhancing the Paid Parental Leave scheme

Proposed effective date: 1 July 2023

Currently, the Paid Parental Leave scheme is made up of two payments for eligible carers of a newborn or recently adopted child: – Parental Leave Pay of up to 18 weeks at a rate based on the national minimum wage. – Dad and Partner Pay of up to 2 weeks at a rate based on the national minimum wage. The Government plans to create a single scheme of up to 20 weeks, fully flexible and shareable for working parents within two years of their child’s birth or adoption. Single parents will also benefit from the extended 20-week entitlement. The income test will also be broadened. Parents who don’t meet the individual income threshold (currently $151,350) can still qualify for payment if they meet a family income threshold of $350,000 a year.

Lowering the Pharmaceutical Benefits Scheme (PBS) threshold

Effective date: 1 July 2022

The Government will reduce the PBS safety net thresholds to support people who have a high demand for prescription medicines due to their health needs. This means approximately 12 fewer scripts for concessional patients and 2 fewer scripts for general patients a year. On reaching the PBS safety net, concessional patients will receive their PBS medicines at no cost for the rest of the year, and general patients will pay the concessional co-payment rate (currently $6.80 per prescription).

Housing affordability

Proposed effective date: 1 July 2022 or 1 October 2022 depending on the specific scheme.

The Home Guarantee Scheme allows first home buyers to build or purchase a newly built home with a low deposit, replacing the need for commercial lenders’ mortgage insurance. The Government is expanding the scheme to make available: – 35,000 guarantees each year (up from the current 10,000) from 1 July 2022 under the First Home Guarantee, to support eligible first homebuyers to build or purchase a newly built home with a deposit as low as 5%. – 10,000 guarantees each year from 1 October 2022 to 30 June 2025 under a new Regional Home Guarantee, to support eligible homebuyers (including non-first home buyers and permanent residents), to purchase or construct a new home in regional areas with a deposit as low as 5%. – 5,000 guarantees each year from 1 July 2022 to 30 June 2025 to expand the Family Home Guarantee. This program enables eligible single parents with dependants to enter or re-enter the housing market with a deposit as little as 2%. Eligible first home buyers may also be able to take advantage of the First Home Super Saver Scheme which allows them to use the concessionally taxed super system to save their first home deposit. Other federal and state grants and stamp duty concessions may also be available.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L.

Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, You can read our Financial Services Guide online for information about our services, including the fees and other benefits All information on this website is subject to change without notice. Please consult professional advice before you act on any of this general information.