“No, we will never advertise!”, Reed Hastings co-founder of Netflix

The key numbers for Netflix

Netflix lost over 200,000 subscribers in the last quarter and expects to lose millions more.

A third of all Netflix subscribers get it for free

It now looks as though advertising may be its saving grace but will subscribers buy it? Netflix added 18 Million paid subs last year, versus 37 Million in 2020. Now it’s losing subscriptions at a fast pace.

Coronavirus fundamentally changed people’s reasons for watching TV. Television provided a sanctuary during lockdown for those seeking familiar and “safe” content which offered an escape from the worrying realities of the pandemic.

They valued companionship much more than before, regularly viewing at home with other members of their family. TV became more of a talking point – within the household and on social media – allowing a sense of connection with others. Online streaming services were particularly effective at fulfilling these needs – seen as safe spaces with content that everyone could enjoy.

Should Netflix be in your portfolio?

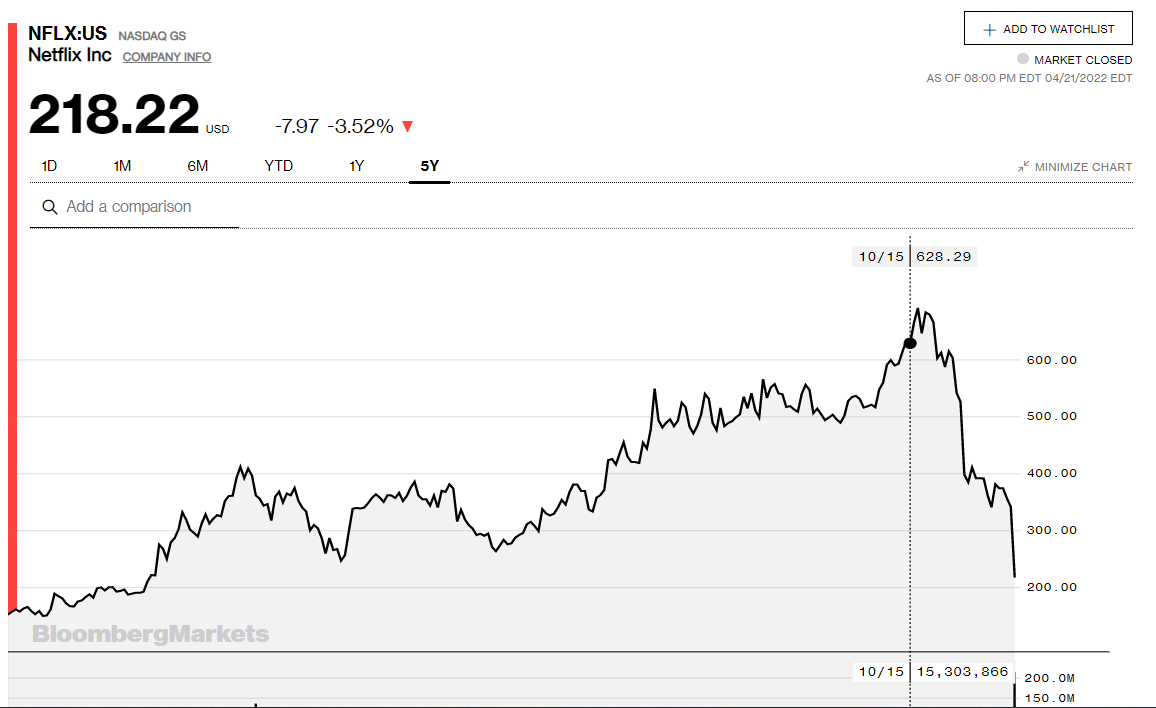

If a share drops by 57% in a year, it generally means you should remove it from your portfolio and count your losses. Netflix’ demise for investors in Nasdaq is minimal with an allocation of only 0.80%.

Here are some reasons why buying Netflix might be positive.

- Valuation. The drop in the stock price following earnings slammed tech investors across the board. Amid a slight decline in its subscriber base compared with the fourth quarter, Netflix stock wiped out more than four years’ worth of gains.

In pre-pandemic days, Netflix typically sold for a P/E ratio of over 100. Its price-to-earnings ratio now stands at 20. - Good Financial stability. Revenue of just under $7.9 billion grew 10%. Despite the sequential drop in subscribers, numbers still rose 7% year over year to just under 222 million. Total debt fell by $858 million over twelve months, adding strength to its balance sheet.

- A cost increase that will take its standard plan from $13.99 per month to $15.49 per month. It also plans a lower-cost, ad-supported option to attract customers who think its current service costs too much, and a move into gaming could increase interest in the platform.

Should you sell it!

The biggest challenge now for Netflix hinges on whether it has LOST IT’S COMPETITIVE ADVANTAGE.

The company has a history of strong, strategic decision-making. Netflix pioneered the streaming industry, and when competitors emerged, it pivoted to proprietary content.

That allowed it to attract subscribers in over 190 countries and helped win awards for its programming. Now, numerous streaming channels exist, and the major ones offer their own proprietary content.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement.

Target Market Determination. We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives.” or terms and conditions, You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.