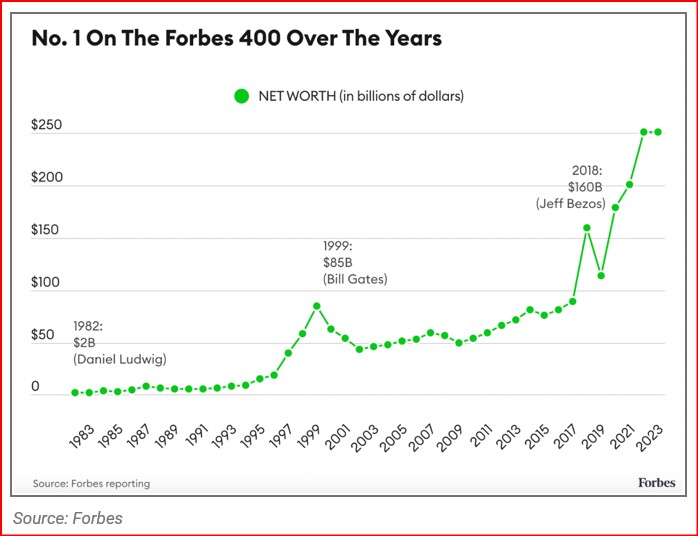

The net worth of America’s richest person has increased dramatically over the years. Forbes recently released its latest list of the 400 richest Americans, and Elon Musk took the No. 1 spot yet again with a net worth of just over $250B. Driven by rebounding stock markets and the AI-fueled techboom, the overall wealth of the Forbes 400 has increased by $500B over the past year. Speaking to AI’s profound impact, the list’s biggest gainer (climbing 31spots) is Jensen Huang, the co-founder of AI chip developer Nvidia.

The upwardly richer

The new kid on the block

Jensen Huang

President of NVIDIA

Jensen received his undergraduate degree in electrical engineering from Oregon State University in 1984, and his master’s degree in electrical engineering from Stanford University in 1992.

What has catapulted Nvidia into the trillion dollar club

The stock’s value has tripled in less than eight months, reflecting the surge in interest in artificial intelligence following rapid advances in generative AI, which can engage in human-like conversation and craft everything from jokes to poetry. Just four other U.S. companies currently have a valuation of more than $1 trillion – Apple Inc (AAPL.O), Alphabet Inc (GOOGL.O), Microsoft Corp (MSFT.O) and Amazon.com Inc (AMZN.O).

Big Tech companies have shifted focus to AI, hoping the technology will attract demand. The computers that power generative AI run on powerful chips called graphics processing units (GPUs) – of which 80% are produced by Nvidia, according to analysts.

Big Tech companies have shifted focus to AI, hoping the technology will attract demand. The computers that power generative AI run on powerful chips called graphics processing units (GPUs) – of which 80% are produced by Nvidia, according to analysts.

OpenAI-owned ChatGPT’s rapid success has prompted tech giants such as Alphabet and Microsoft to make the most of generative AI. The company’s business rapidly expanded during the pandemic when gaming took off, cloud adoption surged and crypto enthusiasts turned to its chips for mining coins. Huang’s bet on AI is expected to fuel growth in the coming months.

What are the other competitors to Nvidea

NVIDIA faces competition from several companies in various segments of the market. Some notable competitors include:

- AMD (Advanced Micro Devices): AMD is a major competitor to NVIDIA, particularly in the GPU market. They offer Radeon graphics cards that compete with NVIDIA’s GeForce lineup. AMD has gained market share in recent years with their Radeon RX series GPUs, which provide a competitive alternative to NVIDIA’s offerings.

- Intel: While historically known for its processors, Intel has been expanding its presence in the GPU market. They have been developing their Xe graphics architecture, targeted for gaming, data centers, and AI applications. Intel’s entrance into the discrete GPU market puts them in direct competition with NVIDIA.

- Qualcomm: Qualcomm primarily focuses on mobile processors but has also entered the GPU market. Their Adreno GPUs are commonly used in smartphones, tablets, and other mobile devices. Qualcomm’s GPUs compete with NVIDIA’s in areas such as mobile gaming and augmented reality.

- Imagination Technologies: Imagination Technologies specializes in developing GPUs for mobile and embedded devices. Their Power VR GPUs are utilized in a range of products, including smartphones, automotive systems, and IoT devices. Imagination Technologies competes with NVIDIA in markets that require low-power and compact GPU solutions.

- Arm: Arm, a leading provider of semiconductor IP, offers Mali GPUs for mobile, automotive, and embedded devices. While their primary focus is on mobile graphics, Arm is expanding into other markets like automotive infotainment and machine learning. Arm’s Mali GPUs provide competition to NVIDIA’s offerings in certain industries.

- Xilinx: Xilinx is a company known for programmable logic devices, and they have also entered the GPU market with their Alveo accelerator cards. These cards target data centers and AI applications, putting them in competition with NVIDIA’s data center GPUs, such as the Tesla series.

- Huawei: Huawei, a technology giant, has been developing their own GPUs for mobile devices and AI applications. Their HiSilicon Kirin SoCs include Mali GPUs developed by Arm. Huawei’s GPUs compete with NVIDIA in the mobile and AI markets, particularly in regions where their devices have a strong presence.

It’s worth noting that the competition landscape is dynamic, and the market positions of these companies may evolve over time. Additionally, there are other companies that compete with NVIDIA in specific niches, but the ones mentioned above represent some of the key competitors in the overall GPU market.

The final point

To develop a portfolio of these companies would be difficult to manage. You can achieve much of the upside by selecting the appropriate ETF that matches the criteria.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?