That word recession is back on the agenda. Can we predict if and when it will happen?

Economists often use complex mathematical models to forecast the path of the U.S. economy and the likelihood of recession. But simpler indicators such as interest rates, stock price indexes, and monetary aggregates also contain information about future economic activity.

Finance theory suggests that stock prices are determined by expectations about future dividend streams, which in turn are related to the future state of the economy.

The yield curve, specifically the difference between the interest rates on the ten-year Treasury note and the three-month Treasury bill, is a useful forecasting tool for predicting recessions. It outperforms other financial and macroeconomic indicators in predicting recessions two to six quarters ahead. The yield curve is influenced by current monetary policy, future inflation expectations, and expected real interest rates. The yield curve’s ability to forecast recessions is particularly important for policymakers and market participants. The yield curve offers a quick and simple way to assess the probability of a future recession, providing a valuable complement to more complex economic models.

“It looks a lot like the GFC”

Figure 1. Two and ten year yields just ahead of the 2007 – 09 recession

Forecasting the future, as always, is fraught with uncertainty.

Most likely, though, the steepening of the yield curve is signaling that the US economy is shortly about to move into a recession. Of note, in that respect, various key macro/recession indicators continue to

forecast a US recession including: i) The Conference Board’s US leading economic indicators; ii) US corporate credit conditions (which remain tight and are generally followed by a contraction in C&I loan growth (commercial & industrial) the consumer confidence ‘expectations less current conditions’ index which is currently at low levels, and is consistent with a forthcoming recession. As such, and whilst not all good indicators are signalling that recession call (e.g. the US corporate financing gap), most are generating that signal.

It seems impossible to imagine because of near full employment and positive economic growth. Remember this is a future looking model and 2024 may be a tough year.

So what does this mean for Mum and Dad investors.

New governor of the Reserve Bank of Australia, Michele Bullock said, “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks”.

As we wait for the next board meeting on Melbourne Cup day it will be an each way bet whether interest rates will increase or not to take some of the heat out of the market.

Some experts are warning there is a chance the economy could fall into recession next year.

A panel of economists questioned by Finder for its RBA Survey have said there is a roughly one-in-three chance that Australia will find itself in a recession in 2024. The survey placed the risk at 32 per cent. However, there are risks from weak growth in China. If the US economy deteriorates, then a recession in mid-2024 is possible. If their is a recession in Australia in 2024 it may only be in name and not a material difference in the way we live.

Interest rate increases on Individual debt is not the only concern. What about Government Debt?

The US federal government wound up its fiscal year in September with a deficit just shy of $1.7 trillion. Wrapping up a year in which some thought the shortfall could exceed $2 trillion, the U.S. ended up with an imbalance of $1.695 trillion, up about $320 billion, or 23.2%, from fiscal 2022.

The budget shortfall adds to the staggering U.S. debt total, which stood at $33.6 trillion earlier this month. The deficit level was eased somewhat when the Supreme Court stopped President Biden’s effort to erase billions in student loan debt.

Of the government outlays last year, some $659 billion went for net interest on the accumulated debt, up from $475 billion in fiscal 2022. That is why a continual increase in interest rates is a major concern.

Janet Yellen, U.S. Secretary of the Treasury

“The U.S. economy remains resilient despite global headwinds,” Yellen said. “Previous expectations that the U.S. would fall into recession over the course of 2023 have not borne out.”

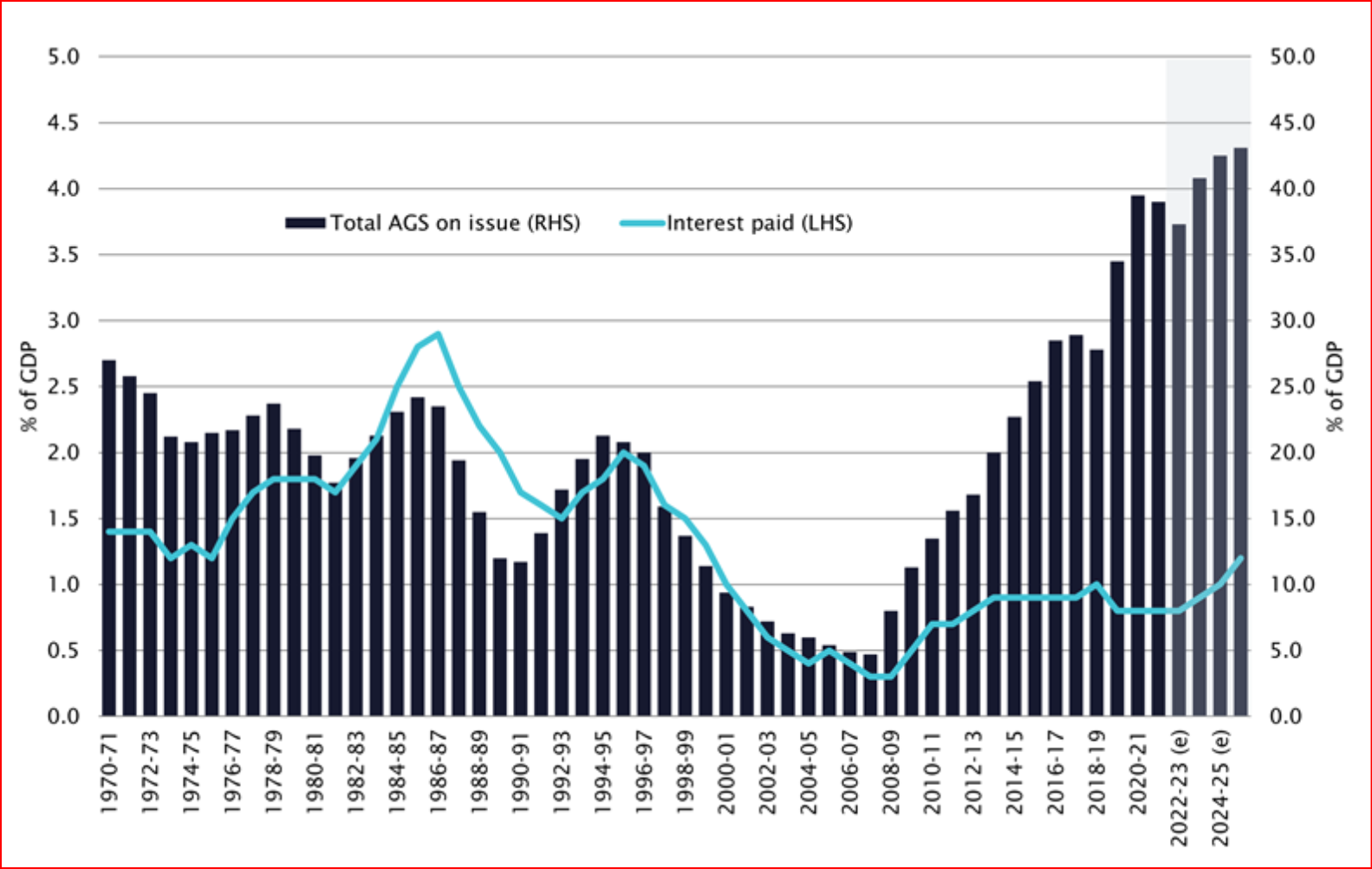

Australian Government total AGS on issue (gross debt) and interest paid

In dollar terms, gross debt is forecast to increase to reach a trillion dollars in 2023–24, reaching a peak over the forward estimates of $1.186 trillion in April 2026. While current and forecast debt to GDP ratios are high relative to recent history, they are still well below the peak reached following the Second World War of over 120% of GDP.

In dollar terms, gross debt is forecast to increase to reach a trillion dollars in 2023–24, reaching a peak over the forward estimates of $1.186 trillion in April 2026. While current and forecast debt to GDP ratios are high relative to recent history, they are still well below the peak reached following the Second World War of over 120% of GDP.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?