30 October 2020

“The polls may favour Biden, but everyone has post-traumatic stress disorder from 2016 when all polls showed Hillary Clinton would win. Elections are anything but predictable these days, and I am just happy that we are finally just a week away and all of the hypotheticals will be answered. I have no idea who will win. My fingers are crossed.” Democrat Mark Kellman

Donald Trump has consistently trailed Joe Biden by high single digits in polling averages. His approval rating has consistently been underwater. On the polling alone, Trump needs a miracle to win re-election. But he needed one in 2016, too. A good sign for Trump is that the US economy is largely continuing its march to recovery. However, Congress still hasn’t passed a new coronavirus stimulus bill. As an investor, will a change or presidency be good or bad for the share market? The overall view is that the market has priced in a Democrat victory and the main concern is controlling the virus, not who will win the election. Is it a good time to jump into the market or sit and wait?

What to invest in now? Can you really believe these returns.

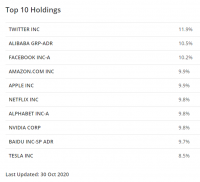

Have a look at the portfolio below that we have constructed from businesses enjoying huge beneficiaries of the change in the way we work and the way we live, and the belief that a Coronavirus vaccine is imminent.

Imagine if you could have one share that covered the top technology stocks globally.

We are specialists in managing portfolio’s for clients. A managed investment scheme has been added to our models. It has been available for 6 months now and has a spectacular uptake by investors and the performance has been amazing. For six months the fund has returned 46.79%.

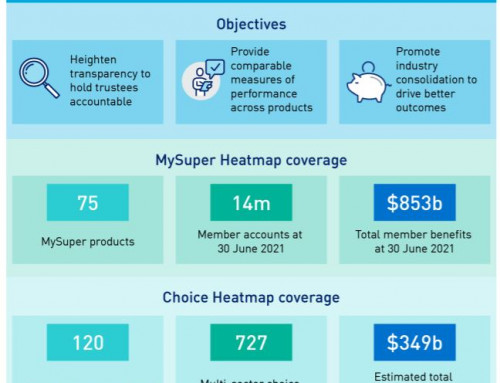

From their fact sheet, the ETFS FANG+ ETF aims to provide investors with a return (before fees and expenses) that tracks the performance of the NYSE®FANG+™ Index by investing in the shares that make up the index in proportion to their index weights. The index focuses on those companies representing high growth technology, or advanced technology, driven sectors such as in the consumer discretionary on the major US stock exchanges.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.