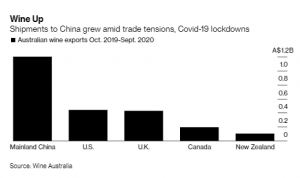

China is escalating trade tensions with Canberra and put on an anti-dumping duty on our wine of up to 212%.

China is the biggest buyer of Australian wine, importing A$1.2 billion ($880 million) in the year through September, according to government marketing body Wine Australia. That’s 167% more than the value of exports to its next biggest market, the U.S.

China has been unhappy with Australia after we banned Huawei Technologies Co. from building their 5G network in 2018. China is also unhappy with Scott Morrison because he asked for a “please explain” into the origin of the Covid-19 virus, a move that bruised China’s pride and unleashed a torrent of criticism that Australia is a puppet of the U.S.

Treasury Wines share dropped about 11.00% before trading was halted today.

Still the big ticket items of iron ore and liquefied natural gas, which together make up more than 50% of Australian exports to China, have been unaffected.

Standing up to China can be costly for Australia.

Ongoing reprisals mean Australia needs to boost under-developed trading relationships with Asian powerhouses such as India and Indonesia and ink new free trade deals with the EU and U.K., following agreements in the past decade with nations such as Japan and South Korea.

Australia is ramping up defense spending and is seeking to shore up security ties with similar “like-minded” democracies.

What about the China share market?

The one year return for the Shanghai Stock exchange composite index has been 19.45% for the last 12 months. This is against the return for the Australian ASX 200 index of 0.08% over the same period. This is barely keeping our head above water.

How can you invest in China and benefit from these numbers?

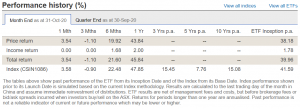

We have recently added the China New ETF (ASX code CNEW) to our approved list on the advice of our asset consultant from London- Longview Economics. This has resulted in some model portfolios lifting their performance over the last six months.

CNEW gives investors a portfolio of the most fundamentally sound companies in China having the best growth prospects in sectors making up ‘the New Economy’, namely technology, health care, consumer staples and consumer discretionary. CNEW aims to provide investment returns, before fees and other costs, which track the performance of the Index.

Performance. 45.84% for last 12 months

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.