18 September 2020

Be Careful what state you die in, it could cost thousands.

Have you ever wondered what would happen if you died without a Will?

The first thing to consider is where you live and whether you have an ex- spouse that may have a claim over your estate.

In our financial planning practice, we have had recent experiences that have shone the torch on the importance of looking closely at this issue.

No matter what your age, and in the current Covid-19 environment, the idea of dying has attracted a lot of community attention.

Furthermore, where you die can have an even bigger impact on the assets that you may have accumulated over your lifetime. Even if you have not been a good saver, you still might have an insurance policy or policies attached to your super accounts that need to be divided among family members or somebody who make stake a claim. If this is not done correctly then it can be a disaster and cause major rifts in families.

Is a text on a phone a valid Will?

In a recent court case regarding a deceased estate, a message on a phone was considered a valid Will, even without it being sent.

A recent case of a person who committed suicide prepared his Will as text on his mobile phone from his car moments before his death. It outlined his wishes clearly. However, he forgot to send it to his appointed executor.

The court found that it was a valid Will and his wishes were implemented.

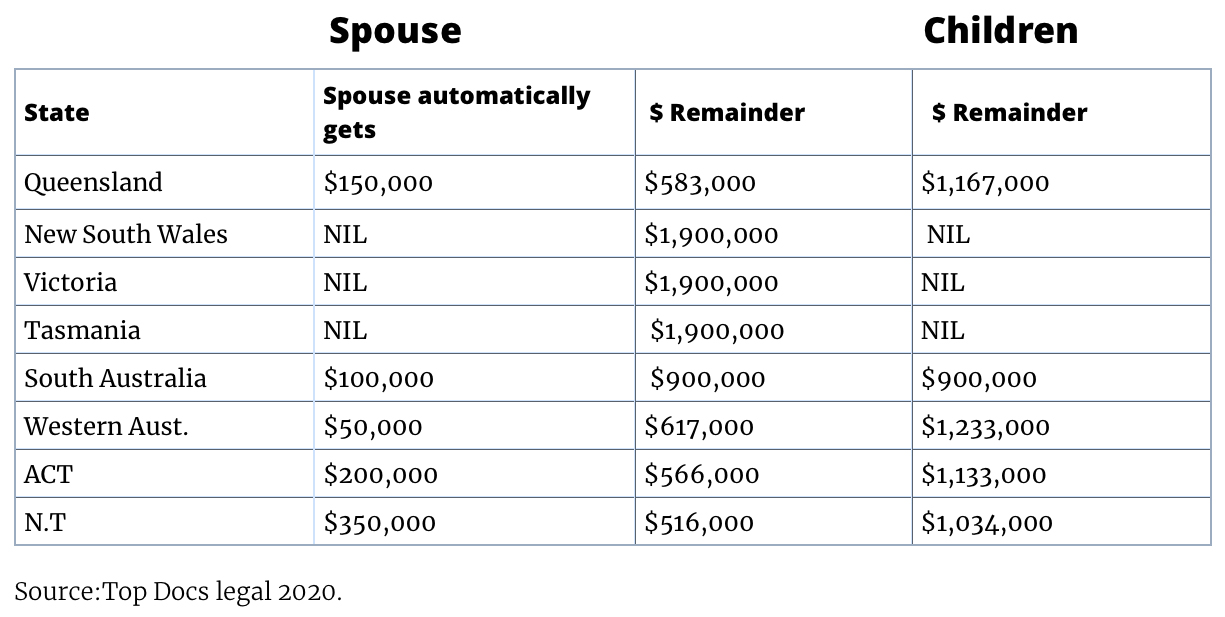

The below table details the various State Intestacy laws and what happens to a person’s estate if no valid Will is in place. This may come as very unpleasant news to some readers.

The table below is based on an example of a husband and wife who have 3 children of that relationship and the value of the estate (excluding chattels) is $1.9 million. The chattels automatically will go to the remaining spouse as will the family home if owned in joint names.

Please note that in the event of intestacy, the distribution of the deceased’s assets will be in accordance with the laws of intestacy applicable in that jurisdiction.

Have you separated but never got around to getting a divorce?

Some people have been separated for many years and have never gotten around to getting a divorce. Imagine if that spouse had run off and abandoned their partner and children, had never paid any maintenance and then they ended up getting an inheritance that they probably didn’t deserve.

What about couples who are in a blended family?

The laws of intestacy may prevent a step-child from receiving anything from their step parent’s estate, which may not be the intention of the deceased step parent. The risk of disputes over an estate is particularly high where there are blended families or beneficiaries with special needs.

For people who have interests in businesses (companies, partnerships or even sole traders), the intestacy laws can have adverse impacts on the ownership of the interests, and in many cases, the control of the business which effects not just the immediate family of the deceased, but also co-owners.

As life circumstances change, it is essential that adults make a Will, or review and update their current one.

You can get a basic affordable online Will as a starting point, please refer to financialchoice.com.au for more information. You won’t regret it.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.